This is a blog I wrote after presenting to the University of Westminster MBA Networking Club on 3/10/2017

It is never too early to plan your exit!

23 years after graduating with an MBA from the University of Westminster I found myself in the Business School presenting to the MBA Networking Club with an audience of past and present students. Judging from the interest and feedback I have had after the presentation, I have decided to write a piece on the subject.

I help owners of private businesses sell them, I also find businesses for buyers looking to acquire. According to the Federation of Small Businesses there were 5.5 million private businesses in the UK at the end of 2016, a growth of 2 million since 2000. Some estimates suggest that 25% of those are up for sale at any moment in time, the reality is a large proportion of those will not actually sell! We’ll explore the reason why in more detail, but some of it is undoubtedly oversupply. Take my home town Guildford, 10 years ago there were 3 barber / men’s hairdressers shops, today Guildford has 9, so if you were looking to buy a barber shop, would you buy one in Guildford or find a less competitive market place?

Back in 2007/8 I led a team trying to purchase a brewery, we had a detailed plan in place and investors lined up, the majority of the capital was going to be provided by a merchant bank, we were raising 7 times EBITDA………………….. Then I got a call, the astute amongst you will have spotted the date, we were backing up against the looming credit crunch and financial crash, the message was that “we are very sorry but we can only lend 3 times EBITDA”. The result was that we had to walk away and the shareholders had to shelve their plans and concentrate on running their business. They very nearly achieved their exit plan, but you have to be prepared for the market to change and adjust your plans accordingly.

Business owners wanting to exit, need to plan in order to avoid the many pitfalls that will face them if they don’t, most importantly not achieving a clean exit, a price that meets their expectations and ultimately selling their business

Recently the owner of a pet supplies business wanted to market it, the business turns over in excess of £3m and is well established. The owner has been in the sector all his life, first as an employee of Pedigree, before establishing the business twenty years ago. He is an industry personality, well known in the trade and by show organisers, however he doesn’t have a second in command or management structure supporting him, like many entrepreneurs he is the face of his business. This would leave incoming owners very vulnerable and therefore makes the business unattractive to potential purchasers. Add to this, his profit margin is very low, because his property costs are double those of comparable local businesses and he imports most of his stock, the weaker pound has had an adverse effect on costs. In addition, he runs a large overdraft most months, meaning an incoming owner would need sufficient working capital to cover it. All in all, the business is not currently attractive to purchasers and the owner has been advised to put a plan in place to create a management structure and to improve the business’s profitability by reducing premises rent (by moving) and making sure the cost base is less exposed to currency fluctuations. By doing this, purchasers could be convinced that this is a business with future growth potential.

The reasons owners want to exit, vary from wanting a change of lifestyle, to retire, to pursue other interests, to release themselves from bureaucracy and red tape, or that they recognise that they don’t have the expertise or resources to take their business to the next level. A Brewery owner nearing retirement age wanted to sell the business he and his wife had successfully built up. He had trained with one of Europe’s big brewers and moved to the UK so that could start a brewery and create his own recipes. He and his wife owned the premises, a beautiful mill building and built a house on the land. Despite having created a strong business, the premiums available in the property market meant that more value could be achieved by developing the mill building into apartments, than by selling the mill and business as a going concern. If more time was available then moving the brewery to another premises could have been an option, however it was decided to sell the assets and develop the property.

Another option would have been to find a strategic buyer for the brewery who would have wanted to develop the brands. Other motives to merge with or acquire businesses include: creating synergies by merging operations, entering new markets/ diversification (product, service or geographic) taking control of supply chains, growth and eliminating competition.

2017 M&A activity in the UK is broadly stable with a decrease in total volume of transactions being offset by an overall increase in market value The chart from the ONS below compares quarter1 2017 with quarter 1 2016

There are many exit strategies:

- Finding or selling to a co-owner

- Selling the business to management and or employees

- Finding a financial buyer such as a venture capitalist

- Finding a strategic buyer

- Liquidating some or all the assets

- Selling to a supplier, customer or competitor

- Passing it on to a family buyer

- Listing the company on the markets / IPO

A software company developed a point of sale solution in conjunction with a UK retailer. The retailer decided to develop an in-house solution leaving the company with no strategic partner. Apart from issues with protecting the intellectual property, the company recognised that it did not have the resources and capability to take the product to the next level. The solution was to form a strategic partnership with and potentially be acquired by a larger Eastern European company that has a number of retail solutions, but has a gap in point of sale.

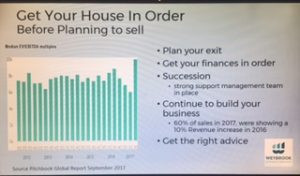

The Pitchbook Global report cites that 60% of companies acquired to date in 2017, showed a 10% or greater growth in 2016. Buyers are looking for future growth and potential, something the senior partner of a recruitment consultancy should have realised when she blocked the succession of the junior partner. He got frustrated and left, taking with him over half the billings and account relationships, as well as key members of staff. If the senior partner had passed the business to the junior partner she would have realised more value for her share, than she will now get for the whole of the business.

The message is you need to plan your exit well in advance, by making sure the business is demonstrating real growth, that the finances are in order, that there are no legal issues and that you have a team in place who will deliver continuity and growth after your departure. Exiting owners must not take their foot of the pedal looking for new owners, the solution is get good advice and the right partners to help the exit, this includes commercial lawyers, a good Finance director (think about hiring a part time or Non-Executive Finance Director) and of course the right broker.

Many years ago, I had a boss who had a plaque on his wall reading “Failing to plan, is planning to fail,” that message has stuck with me and is so often pertinent, it certainly is if you want a clean exit from your business, finding the right buyer, willing to pay right price, at the time that you want.

Rupert Trevelyan

Managing Director

Weybrook Business Brokers

www.weybrookbusinessbrokers.com

rupert@weybrookbusinessbrokers.com